Online Valuation Formula

Most online businesses are valued using one of the two most common formulas – SDE and EBITDA.

SDE, or seller's discretion earnings, is the most common method for valuing a small business. Any online business operating on a small scale is valued through SDE methods, which involves – calculating the net worth before tax by subtracting the cost of goods sold and necessary operational expenses from the revenue.

While calculating the net worth of an online business, the owner's salary is added back, which gives us the company's actual income. Discretionary earnings are also added back. Discretionary earnings include costs such as life insurance and credit card charges that are unnecessary to operate the business. The new owner will not bear these costs.

The SDE method provides a fair idea of how a business performs on a pure cash flow basis. In this method, the current owner is excluded from knowing how much business will make when anyone takes it. The SDE method is most suitable for any small-sized business with annual revenue of about $5 million.

Businesses with more than $5 million in annual revenue are valued using a more complex method – EBITDA. The technique calculates earnings before interest tax, depreciation, and amortization. The EBITDA method is used in a complex business structure with more managers and staff on payroll.

EBITDA adds back any excessive owner salary compared to the manager's salary. The EBITDA valuation method helps prospective owners plan acquisitions by comparing similar businesses in the marketplace. Large online businesses or companies usually have more than one owner. Such businesses are owned by a private funding group where profit is divided on the pre-decided ratio.

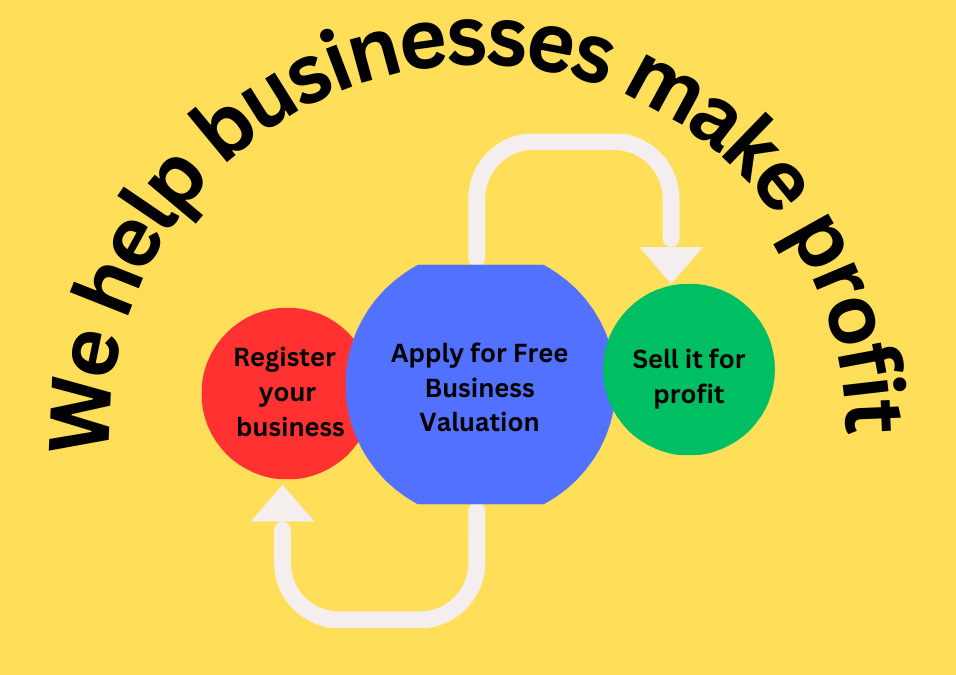

Every business owner looking to sell an online business should know that the company's accurate valuation is essential for growth. If you need help calculating your business net worth, we have an exit planning team that can assist in calculating precise valuation for free.

How to Use Our Online Business Valuation Calculator

It takes a few minutes to fill in your business details for our team to calculate your business net worth. You may be asked to provide information related to your business that may include:

- The date the business was created

- Average monthly gross revenue and expenses

- Average monthly unique visitors ( for website or e-stores)

- The number of email subscribers (if any)

- Number of social media followers (if any)

- Additional business-specific information includes revenue models, the number of products, and more.

Using the information, we can instantly estimate the value of your business. Here, it is essential to mention that valuation and the listing prices can differ. The listing price can be different from the accurate valuation of any company.

Why is the online valuation of a website essential?

Online valuation of a business is crucial because it provides an idea of how your business is doing financially and what efforts you can take to embrace growth. Valuation can be carried out at any time when the company is operational. It is not necessarily for selling or buying the businesses. It is also true that online businesses are attracting new owners and buyers, for they bring a lot of opportunity and scope for growth.

Why Owners Sell Their Online Businesses?

There are many reasons why owners decide to sell their businesses. Most of the time, the online companies are sold for growth. Small businesses may sell part of their business to raise funds for a new venture.

Many Businesses Don't Even Realize Their True Worth

Many online businesses are doing so well on the internet and need to be made aware of the worth they add to the marketplace. Valuation helps online companies understand where they stand in the competition and how much their resale value is. Business owners are often overburdened with routine work pressure and even lose trust in growth. Accurate valuation of an online business can help business owners regain trust and confidence in expanding and growing in the marketplace.